Research by Daniel Enemark, Ph.D., San Diego Workforce Partnership Senior Economist

Share Our Facebook Post | Download PDF

Executive Summary

As a result of the COVID-19 pandemic and the social distancing required to prevent its spread, workers in seven of the ten occupations with the most jobs in San Diego County are at high risk of immediate layoffs, reduced hours and/or long-term displacement. In the first three days of partial closures (March 16-18), Californians submitted 190,000 unemployment insurance claims—more than quadruple the weekly average—and the March 19 statewide order to shelter in place will bring more layoffs.

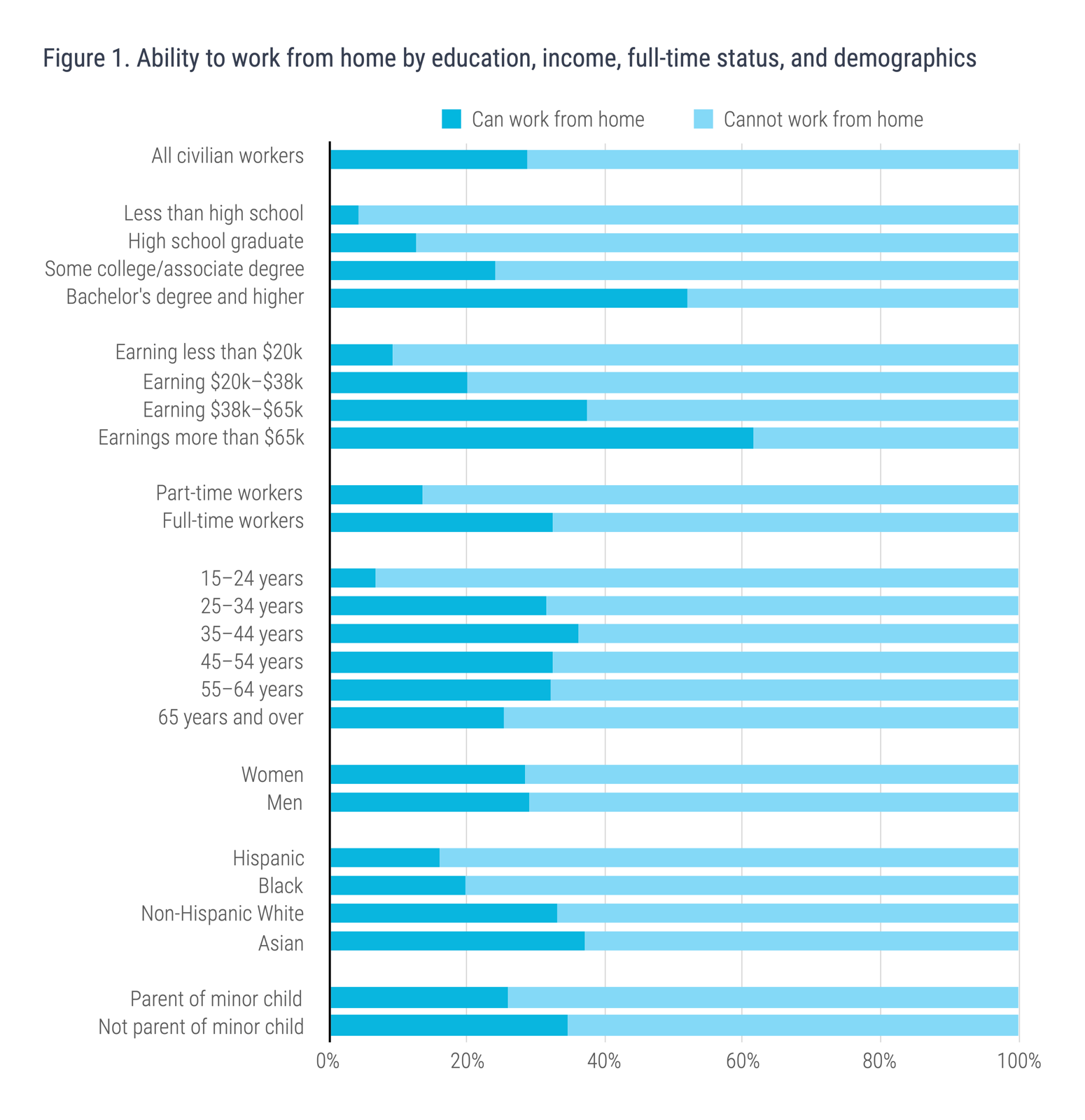

The economic consequences of the pandemic will be more severe for certain groups of workers. In the US from 2017-18, less than one-fifth of Hispanic and black workers had the option to work from home, while more than a third of white and Asian workers were allowed or able to do so. This suggests that COVID-19-related layoffs will likely do more economic harm to Hispanic and black workers. The same data suggest that younger, less-educated, lower-income and part-time workers are less likely to have the option to work from home. In other words, it is the least financially secure workers who are most at risk in the COVID-19 crisis.

If workers who lose their jobs and income in the short term do not receive immediate relief, they will stop spending money. The resulting reduced consumer spending may lead to a deeper, long-term recession that will threaten many more jobs. The San Diego Workforce Partnership is on the front lines of this impact to workers and businesses and is already seeing evidence of the pandemic’s economic and human impact.

Between March 16-22, the Workforce Partnership received notices or phone calls from 52 employers that are considering or have executed layoffs or work-hour reductions for a total of 3,865 impacted workers. We know this is only a small fraction of the jobs lost to COVID-19 in San Diego county, and we expect these notices to increase in the weeks ahead.

This report explains the drivers of these job losses, as well as which occupations, businesses and workers are most likely to be impacted in the short term. The goal of this report is to help prepare for and inform the region’s economic response to the COVID-19 pandemic.

For those currently impacted by the pandemic and looking for help, the latest information is available on our website now:

- workforce.org/covid-19 for workers

- workforce.org/covid-19-bus for employers

Employers can also call (619) 228-2982 for assistance within one business day

COVID-19 Poses Short-term and Long-term Threats to Employment

In the short term, the mandated social distancing and California Governor Gavin Newsom’s order to ‘shelter in place’ to slow down the spread of COVID-19 has resulted in the scale-back or temporary closure of many businesses, resulting in layoffs in occupations that require customer interaction, like retail sales and restaurant wait staff. In just three days from March 16-18, 190,000 Californians submitted unemployment insurance claims, four times the typical weekly average and more than have been submitted in any single week this century.

We anticipate many more layoffs in the coming weeks. Even at businesses that continue to operate through remote work, employees whose roles do not allow them to work from home, like janitorial staff, airline workers, food service staff, and retail associates, will likely be laid 5. off as long as social distancing measures persist.1

The long-term threat is that laid-off workers’ drop in income will drive down consumer spending, and the resulting reduction in business revenues will lead to wider-scale layoffs affecting jobs not currently threatened by the pandemic itself. In other words, in the short term, many jobs are at risk; in the long term, many more jobs are at risk.

Economists and financial institutions increasingly expect COVID-19 to spark a recession,2 but the depth and duration of any recession are impossible to predict. How many jobs are lost for how long depends on many factors, including how much consumer spending decreases.

To stabilize consumer spending, workers need money to spend and in their bank accounts. That depends on many factors, including how long the virus necessitates social distancing measures, the resources employers are able to access to sustain payroll, and how quickly, aggressively and effectively federal, state, and local governments act to provide relief.

Since the factors determining the depth and length of a long-term, nationwide recession are impossible to predict, and difficult for regional actors to influence, the remainder of this report focuses on the immediate, local employment impact.

Short-term Job Losses Will Vary by Occupation

Under the mandatory “shelter in place” requirements, the opportunity for workers to continue earning a paycheck depends crucially on the suitability of their job for remote work (unless their job is considered essential during the pandemic response3).

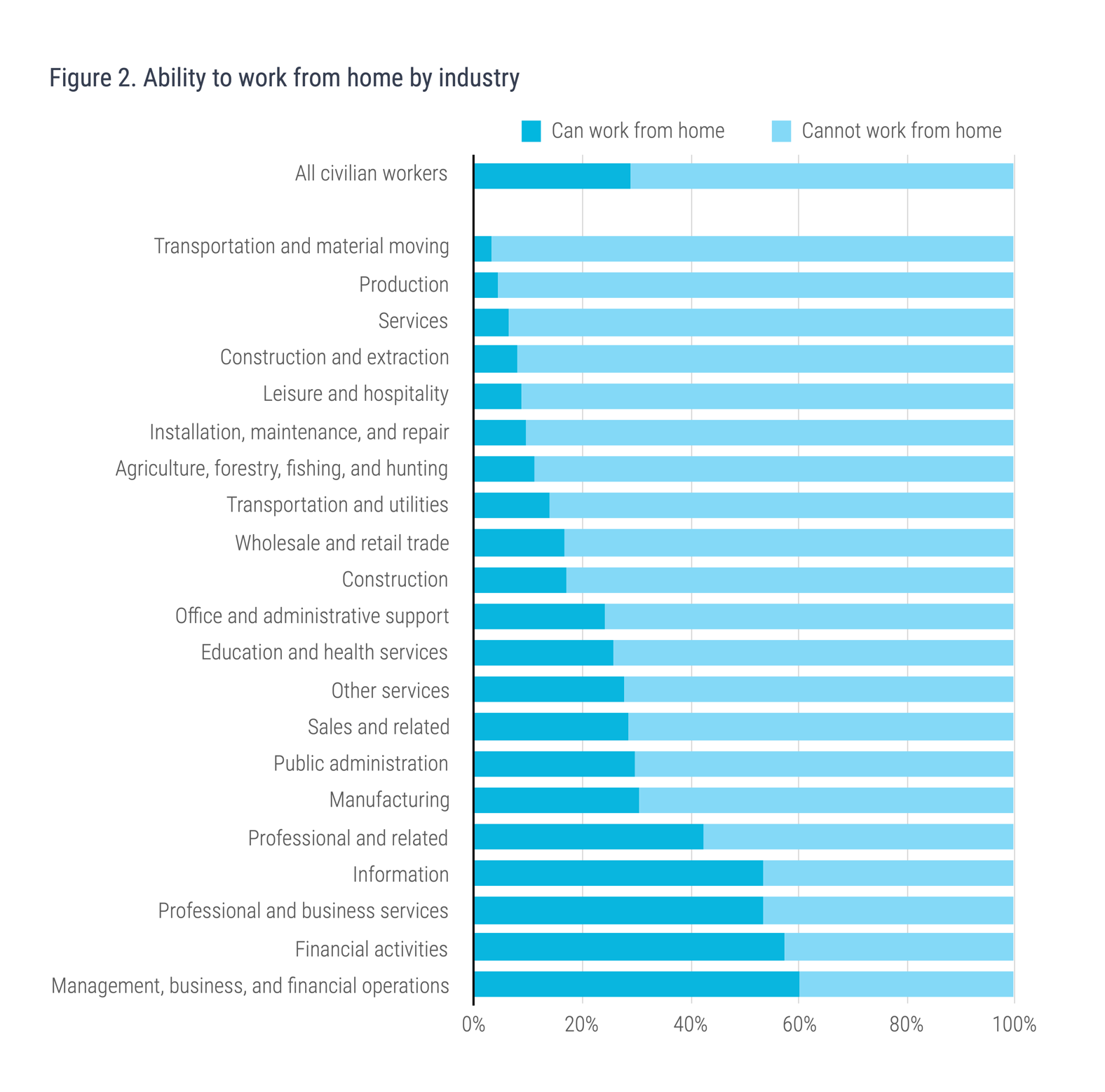

Unfortunately, many jobs cannot be done remotely, either because the tasks are not suitable for remote work and/or because the worker is not equipped with the necessary technology, knowledge to effectively use technology, and their home internet service. According to the Bureau of Labor statistics, only 29% of America’s 144 million workers are able to work from home (these numbers exclude the self-employed). As the need for social distancing results in continued inability for workers to leave their homes, we expect to see more job loss.

Figure 1 shows that the opportunity to work from home is not evenly distributed among all workers. Full-time, high-paid, educated workers are more likely to have jobs that can be performed remotely. And because education and wealth are unevenly distributed by age, sex, race and family status, it is also true that the ability to work remotely is correlated with these traits. Especially disconcerting is the racial/ethnic gap: less than one-fifth of Hispanic and black workers can work remotely, while more than a third of white and Asian workers can.

Figure 2 shows the ability to work remotely by industry, ranging from 3% of transportation workers to 60% of management, business and financial operations workers.

Based on these data, the Workforce Partnership is preparing for elevated rates of unemployment among young workers, those with part-time hours, those with low education and income, workers from industries with low rates of opportunity to work from home.

The Workforce Partnership evaluated the top occupations in San Diego County (ranked by number of workers) according to the factors discussed above: ability to support work from home, industry sector, average education, income level, hours, access to paid leave, full-time status and unionization of workers in the occupation. From that analysis, we can estimate which occupations are most at risk of job loss as the COVID-19 pandemic continues.

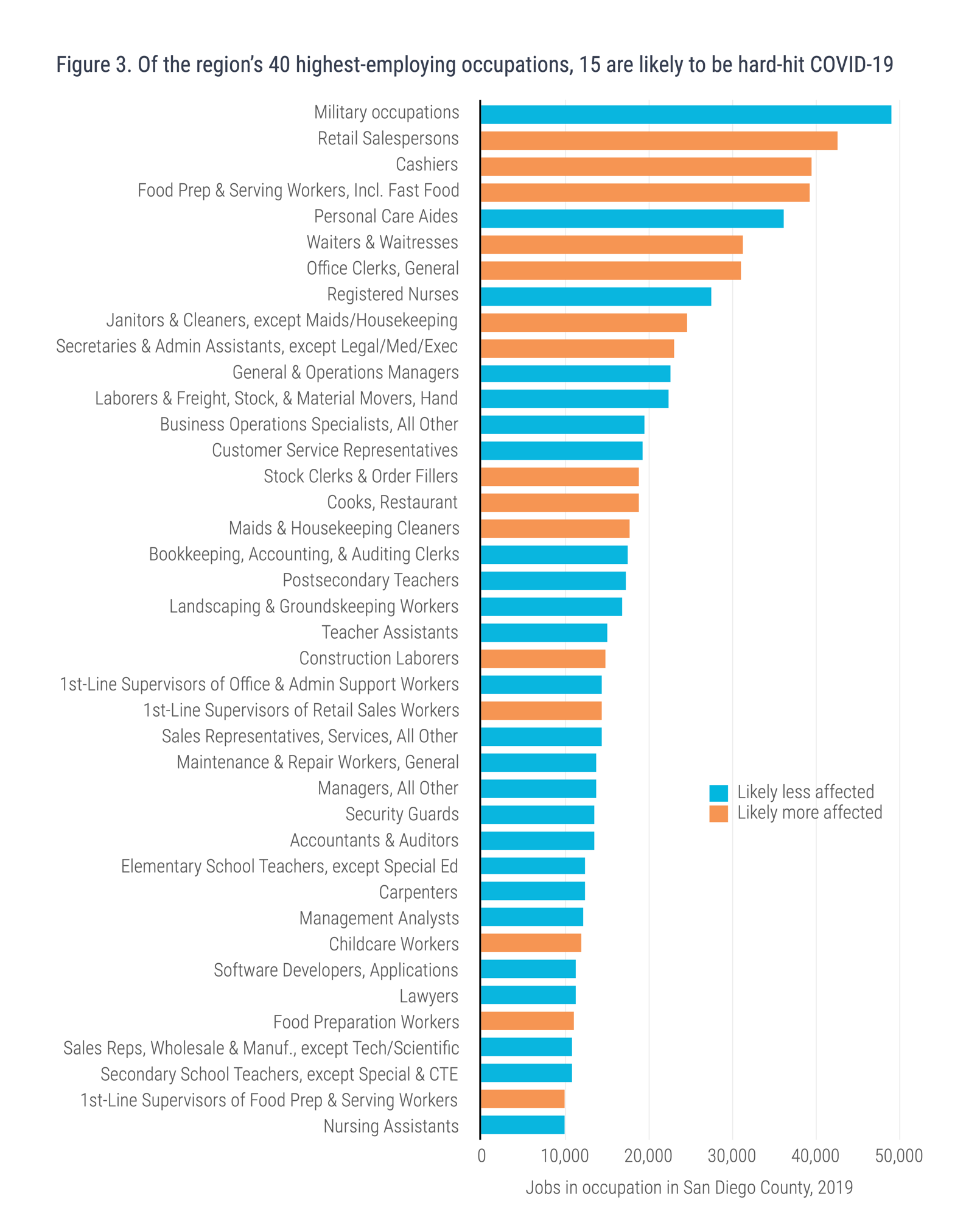

Figure 3 shows the top 40 occupations in San Diego County, accounting for 790,000 jobs—nearly half of all jobs in the region. The 15 occupations highlighted in orange (employing 350,000 workers) are likely at high risk of layoffs and reduced hours. How many of those 350,000 jobs are lost in the short term depends on the course of the pandemic and the effectiveness of efforts by government, businesses, nonprofit and philanthropic sectors to mitigate the economic impact of COVID-19.

Job Losses Will Vary by Industry Sector and Business Size

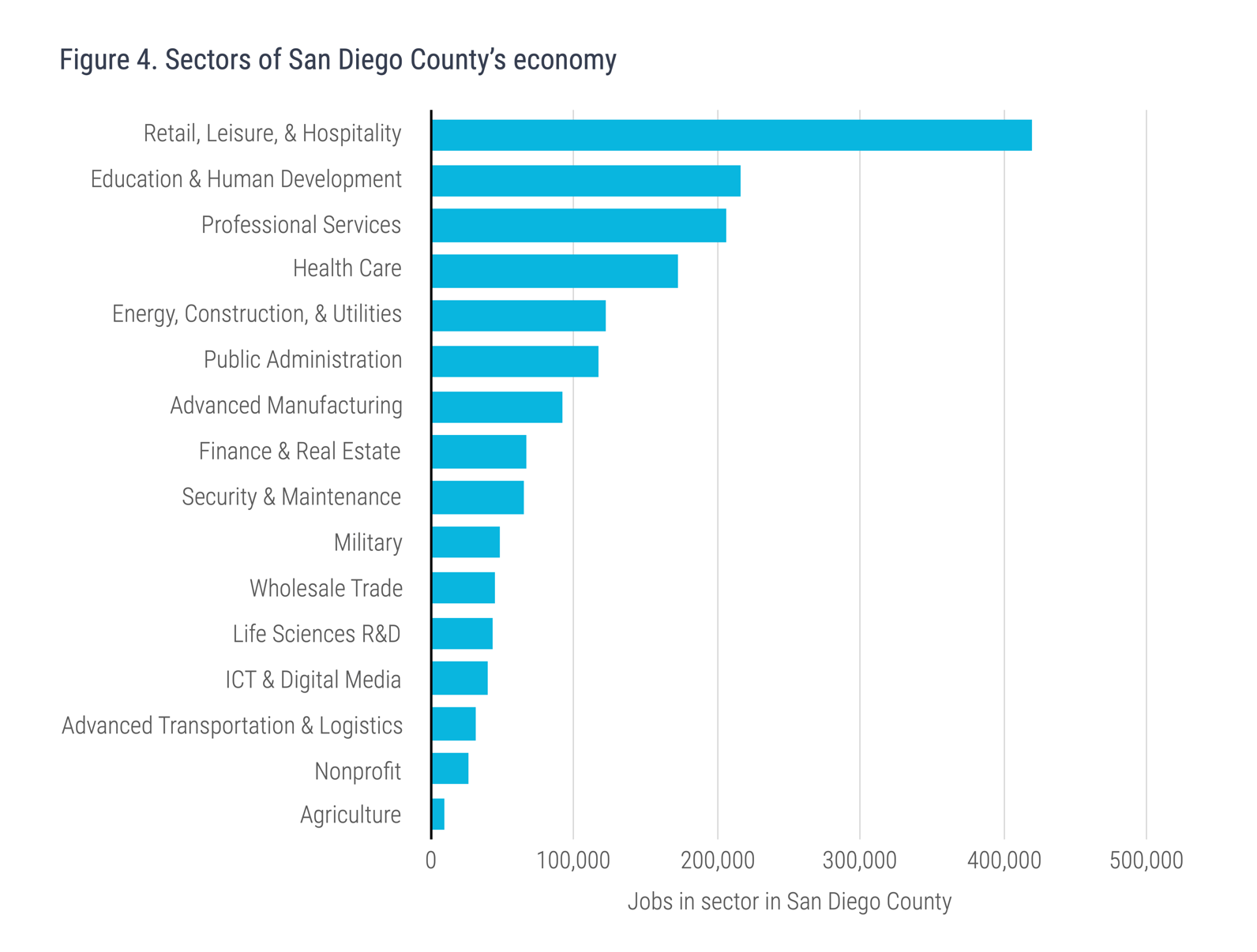

Figure 4 shows sixteen major sectors of our regional economy. While some sectors, such as Health Care, will have steady or even increasing employment needs, several sectors are being devastated by the social distancing necessitated by COVID-19. The hardest-hit sector by far is Retail, Leisure, & Hospitality, which employs more workers than any other sector in our regional economy.4

Non-essential retail and food-service businesses especially face an immediate threat to solvency. Governor Newsom has ordered the closure of all bars and nightclubs. Restaurants may only serve via delivery, pick-up or drive-thru. As a result, many of the region’s local retailers, restaurants and bars will struggle to remain solvent and are taking most, if not all, workers off the payrolls for the time being.

Hospitality has seen a dramatic contraction. As of March 20, the Convention Center had 19 event cancelations adding up to 115,000 lost attendees. Many of those attendees were out-of-towners who would have been staying at hotels. From March 7 to 14, hotel occupancy dropped 33%, and as of March 23, at least 37 hotels were temporarily closed. The Convention Center Corporation estimates these cancellations will cost them $3.7 million and claims this will cost the region nearly $200 million in lost economic impact. These numbers are the latest reported, and many more cancellations continue to occur. Nearly all tourist attractions—the San Diego Zoo, SeaWorld, museums, theatres, etc.—are closed.

Many of the region’s 500 hotels have closed. Hotel taxes contributed $249 million to the San Diego City budget last year (the city’s third-largest source of revenue at 6.5%), so we expect the severe decline in tourism to have a dramatic effect on the city and county budgets, impacting local government services and discretionary spending.

In many industries, the effects of COVID-19 are still uncertain. Energy, Construction, & Utilities may struggle with labor shortages; Advanced Manufacturing may be held up by supply-chain issues; Life Sciences R&D may suffer from an inability to get scientists into the lab.

Finally, many industries will continue steadily—at least for the short term—unless and until a deeper nationwide recession depresses employment throughout the economy. On Friday March 22, California’s State Public Health Officer provided a list of “Essential Critical Infrastructure Workers,” including but not limited to those working in the following fields:

Health care operations and infrastructure; utilities; construction and maintenance; retailers selling food, pet supplies, cleaning and personal care products, hardware, auto supplies, or products necessary for maintenance of residences or essential businesses; gas stations; food cultivators; businesses that provide goods and services to economically disadvantaged people; the media; financial institutions; service providers needed by residences, essential businesses or remote workers; laundromats and laundry service providers; restaurants (but only for take-out or delivery); food services for students; shipping and transportation providers; residential facilities and shelters; home-based care; and childcare.

One example of a sector in high demand during amidst the pandemic is food retailers, especially grocery stores. Another obvious example is Health Care, though the impact is more varied than is often acknowledged; while urgent-care needs are growing, routine and elective services like regular dental cleanings, are being cancelled.

Small businesses will be hit hardest by COVID-19. About 95% of San Diego businesses have fewer than 50 workers, and these businesses employ 45% of our region’s workforce. While large companies typically have large cash reserves that help them maintain payroll in emergencies, medium- and small-sized businesses in San Diego have an average cash buffer of just 18 days.

During the Great Recession, the growth of large companies outpaced that of small companies because small companies lacked the resources to survive prolonged economic contraction. Similarly, the upheaval caused by COVID-19—and especially by any long-term recession—will impact small companies more negatively than it will large firms.

Moreover small companies are less likely to have the IT infrastructure to support remote work; less likely to have multiple revenue sources, allowing a shift to online business; and less likely to provide employees with paid family leave, paid personal leave or paid sick leave, so they are more likely to lose employees who get ill or who must care for an ill family member or child due to school closure.

The Workforce Partnership’s Response

We are focusing on five major areas to best serve workers and businesses impacted by COVID-19:

1. Providing timely, accurate information to workers and businesses while shifting to remote service delivery.

Beginning the week of March 13, 2020 in-person services including our career centers closed to reduce the spread of Covid-19. Impacted workers can still access services remotely, including calling and e-mailing all career center staff, virtual career coaching appointments, information on Unemployment Insurance (UI) benefits, training and employment opportunities, new jobs through our online career portal, and other remote learning and skill building opportunities.

During the week of March 16 – March 20, our business services team has been in touch with 52 employers who have reported layoffs of over 3,865 workers in San Diego. In partnership with the state employment department and a financial planning experts, we are working with these employers and their employees to provide information on the latest unemployment insurance assistance, financial support services such as CalFresh food assistance and utility payment assistance, health care options, financial planning, and other support services available to impacted workers.

Starting the week of March 23, we will be doing daily remote webinars with businesses and their impacted employees.

The latest information is available on our website now:

- workforce.org/covid-19 for workers

- workforce.org/covid-19-bus for employers

Employers can also call (619) 228-2982 for assistance within one business day

2. Facilitating training and hiring events for essential occupations.

We are seeing an increase in temporary hiring in essential occupations related to the front lines of emergency response, such as health care supply chains, food distribution, and transportation and logistics. We are working with companies in these industries to provide remote hiring events, and helping laid-off workers transition, temporarily or full-time, to industries experiencing a spike in demand. Workers interested in these opportunities should visit workforce.org/portal.

We are also structuring a fund for customized, accelerated training opportunities for workers transitioning into critical supply-chain fields, such as food distribution and health care support roles.

3. Helping businesses avoid layoffs through training

We are raising and identifying funds that can be repurposed to provide on-the-job and custom-training business process improvement services for employers and their employees in lieu of layoffs.

We are also shifting our internship programs to place individuals with employers who have remote-work needs, moving them away from discontinued in-person assignments.

4. Focusing on “earn and learn” opportunities for service workers to earn training stipends while learning new, in-demand skills.

We are focused on retraining displaced workers through “earn and learn” opportunities where impacted workers can learn new skills in high-growth, high-wage fields while earning a training stipend.

This strategy will not only put cash into laid-off workers’ hands immediately, it will help thousands of workers get the skills that will lead to high-paying jobs in the post-Covid-19 economy.

5. Bringing additional state and federal funds into the region.

The efforts mentioned above are necessary, but much more is needed. Federal, state, and local government emergency response and long-term stimulus funding is needed to address the needs of workers and business in San Diego during this unprecedented public health crisis and the related economic fall-out.

During the 2009 financial crisis, the American Reinvestment and Recovery Act (ARRA) was passed to stimulate US economic activity. The package injected an estimated $831B into the economy beginning in 2009, including $3.5 billion in additional job training and employment programs that were administered through local workforce development boards.

At the time of writing, a $2 trillion stimulus package is being debated in Congress. The Workforce Partnership is actively working with State of California and US Department of Labor officials to outline effective parameters of emergency grant funding and the regulatory framework for administering federal stimulus funds based on local needs and challenges.

1 Many of these jobs are already outsourced, but the companies that provide those jobs will struggle to keep workers employed as demand for their services decreases.

2 A recession is typically defined as two or more consecutive quarters of decrease in the US GDP (that is, a sustained decrease the total value of goods and services produced). Because recessions are measured in hindsight, it is likely that economists will eventually decide that a US recession began in the current quarter.

3 See below for more discussion of essential activities. State and local governments are working together to determine which activities are deemed essential.

4 While many economists view this category as comprising three or more sectors (including retail trade, food services, and accommodations), at the Workforce Partnership we view these as a single ecosystem, because they are all heavily influenced by tourism.