Workforce Partnership senior economist Daniel Enemark analyzes May’s labor market trends and employment.

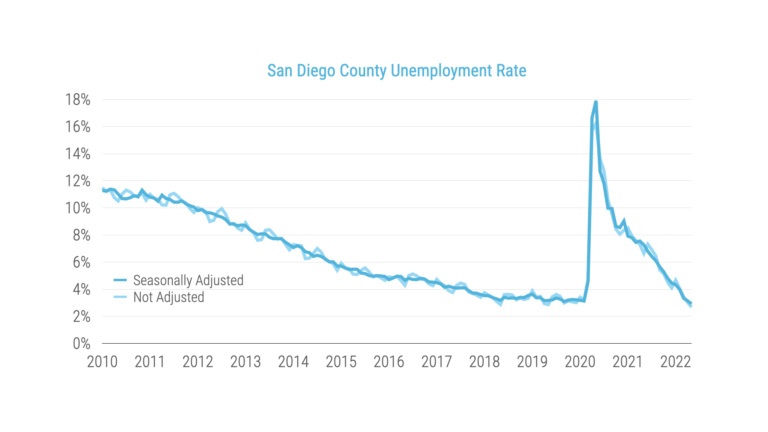

Lowest rate of the century

San Diego County’s unemployment rate dropped to 2.7% last month—the lowest rate this century and the second lowest rate in the 33 years in which County numbers were available. The seasonally adjusted rate was 2.9%, down from an adjusted 3.1% in April.

It’s extraordinary to think that the unemployment rate has dropped beneath its pre-pandemic low. Even Leisure & Hospitality—the hardest-hit sector—is back to 96% of its pre-pandemic employment level. And nationally there are two job openings for every unemployed person. By any measure, this is the tightest labor market of the century. And while fears of an imminent recession may be exaggerated in the media, we don’t know how long this will last. I would encourage anyone who’s been thinking about advancing their career to look for jobs now—but maybe not to quit their current job until they have an offer in hand.

Construction and Leisure & Hospitality

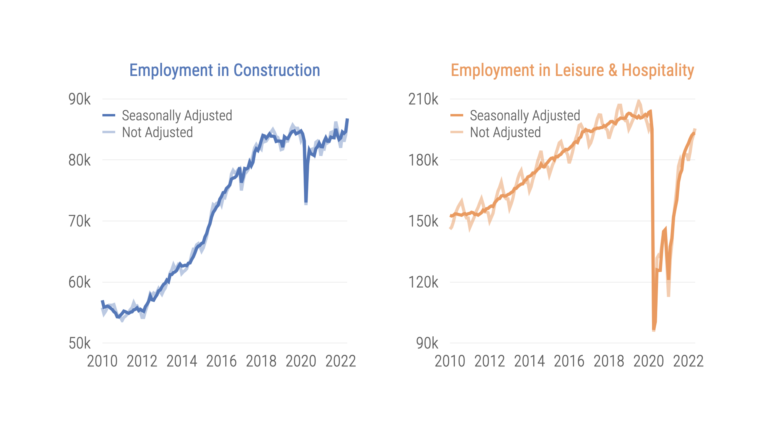

Phil Blair found news for celebration beyond the top-level numbers: “It’s exciting to see construction jobs growing! We need to invest in infrastructure and housing to make San Diego attractive to businesses and affordable for residents.” Indeed, earlier this year the real estate tech firm OJO Labs designated San Diego the least affordable metro in the US, with a median home price more than eight times the median household income.

If you know anyone interested in starting a career in the growing construction sector, apply for Construction Career Jumpstart! This paid, four-week training provides industry-recognized certifications and prepares grads for positions in the skilled trades.

Leisure & Hospitality turned in a second consecutive month of stellar performance, leading all sectors with a net increase of 3,200 jobs. Blair pointed out that “the strong growth may be driven by improved job quality, with higher pay and two weeks’ advanced scheduling becoming the norm.” Leisure & Hospitality employment typically peaks in August, so we look forward to the sector continuing to grow this summer.

Interest rates and recession fears

The big economic news this week was the Fed’s 0.75 percentage point interest-rate hike. While the increase is the largest since 1994, overall rates remain very low by historic standards and lower than the rate recommended by leading academic models (see page 46 of this morning’s Monetary Policy Report). This step was taken to combat inflation, but it’s a tight-rope walk, because curbing inflation with higher interest rates has the potential to increase unemployment. Naturally this has increased fears of a recession, but the truth is that no one knows when the next recession will begin.

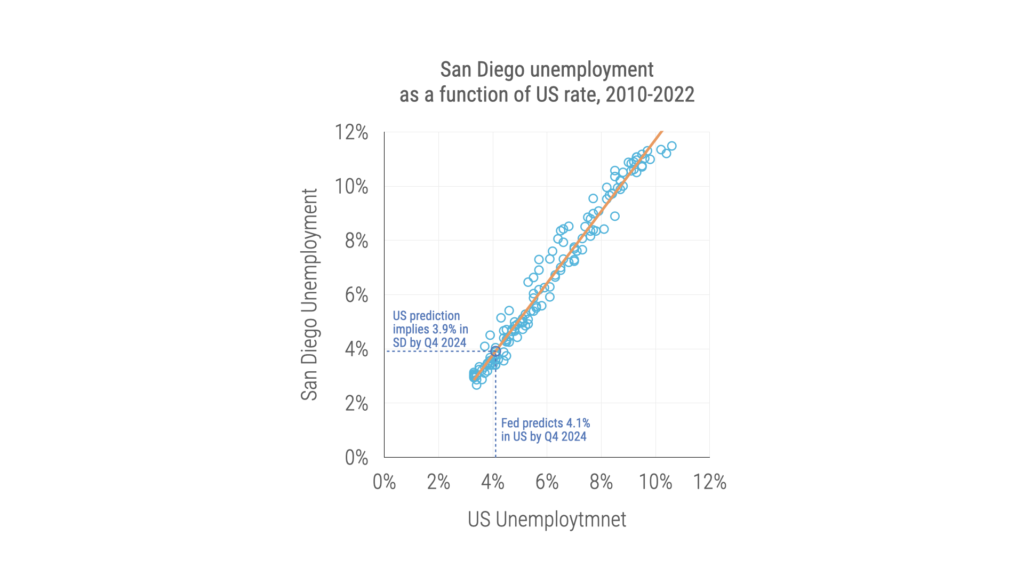

Along with the rate hike, the Fed released updated projections by their seven board members and 12 bank presidents. The median projection for fourth quarter US unemployment was 3.7% in 2022, 3.9% in 2023, and 4.1% in 2024. There tends to be a very tight relationship between US and San Diego County unemployment. (A simple linear model based on US unemployment explains over 97% of the variance in San Diego’s rate.) So we can estimate that if Fed projections turned out to be correct, we would experience 3.4%, 3.6%, and 3.9% inflation in Q4 of 2022, 2023, and 2024 respectively—higher than today’s unemployment but still lower than the rate most economist would expect under “full employment.”