By Alan Gin, Ph.D., associate professor of economics at Knauss School of Business Economic Research Center at the University of San Diego

We partner each year with the County of San Diego and USD to bring the region the Economic Roundtable. At this year’s event, USD shared some findings from the CaliBaja Regional Economy report and covers it further here.

The CaliBaja Region

The term “CaliBaja” is sometimes used to describe the binational region that straddles the 150-mile border between California and Baja California. On the California side is the Southern Border Region, a geopolitical designation that includes San Diego and Imperial Counties. On the Baja California side are the municipalities of Ensenada, Mexicali, Rosarito, San Quintin, Tecate and Tijuana.

The region is home to more than 7 million people and a strong cross-border economy. The bulk of the region’s population live in San Diego (46%) and Tijuana (26%), with the remainder spread between Imperial County and the other Mexican municipalities. A socioeconomic profile of the different entities in the region is given in Table 1.

Table 1. Socioeconomic Profile of the CaliBaja Region, 2020

San Diego | Imperial | Tijuana | Mexicali | Baja California | U.S. | Mexico | |

Population | 3,338,514 | 181,352 | 1,910,568 | 1,042,395 | 3,739,797 | 328,239,523 | 125,515,554 |

Population growth | 7.4% | 3.5% | 23.8% | 11.80% | 19.7% | 6.1% | 12.1% |

Working-age population | 2,112,047 | 106,888 | 1,309,290 | 692,885 | 2,512,771 | 197,101,578 | 79,691,310 |

Years of schooling | 13.7 | 12.4 | 10.2 | 11 | 10.5 | 13.4 | 10.3 |

Hours worked per week | 38.9 | 38.2 | 42.9 | 43.2 | 42.5 | 39.5 | 43.9 |

Monthly Income (USD) | $4,795 | $3,126 | $541 | $597 | $538 | $4,406 | $416 |

Given the significant cross-border activity in the region, border relations have a big impact on the region’s economy and workforce. In the past, there have been numerous threats to close the border. The reasons given ranged from curbing the flow of illegal drugs to reducing the U.S. trade deficit. The outbreak of COVID-19 in 2020 added public health as another reason for banning nonessential travel from Mexico.

Any restriction on cross-border movement would negatively affect the regional workforce in two ways: (1) The regional economy would be negatively impacted, which in turn would negatively impact workers; and (2) a significant portion of the region’s residents frequently cross the international border to go to work, go to school, shop or for entertainment purpose.

The Regional Economy and Cross-Border Trade

The CaliBaja region has a gross domestic product of between $250 and $300 billion. The regional economy is split into a “knowledge economy” centered in San Diego and a manufacturing economy based in Tijuana. The development of the former was initially based largely on the research activities of UC San Diego, affiliated research institutes and the activities its graduates. As the region grew in prominence in areas such as biotechnology and telecommunications, other companies began to locate in San Diego and the region attracted huge amounts of venture capital.

On the Mexican side of the border, Tijuana developed a large manufacturing capacity through maquiladora factories and a large supply of low cost, low skilled labor. Key areas of manufacturing there include automotive parts, audio and video equipment, medical equipment and supplies, semiconductors and electronic equipment, and communications equipment. The attractiveness of the manufacturing environment in Tijuana has attracted significant foreign direct investment (FDI) of more than a billion dollars a year.

One important part of the regional economy is the significant cross-border trade that occurs. According to the California Chamber of Commerce, California exports to Mexico were $24.1 billion in 2020, while imports to the state from Mexico were $47.9 billion, including $4.9 billion in fruits and vegetables.

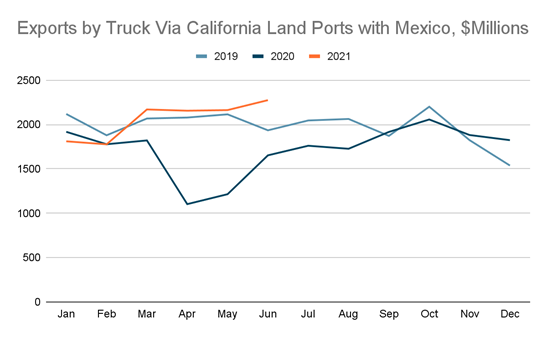

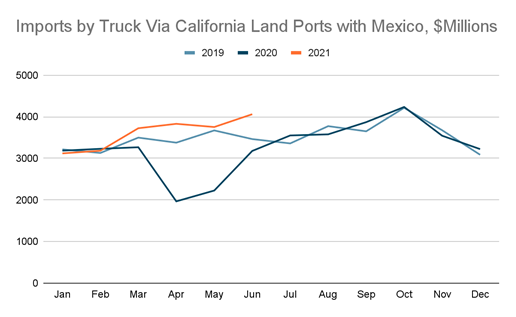

Much of that trade occurs at the CaliBaja ports of entry: San Ysidro, Otay Mesa, Tecate, Calexico West, Calexico East and Andrade. Numerous studies have cataloged the negative economic impacts of the infrastructure deficiencies at the border and the resulting long wait times to cross. In 2019, threats to close the border led to worry about the movement of goods, such as automotive parts, medical devices, and produce. Many of the goods produced in Tijuana’s maquiladoras would have been impacted, which in turn would have affected employment in those facilities. Similarly, restrictions on border crossings in the wake of the outbreak of COVID-19 in March 2020 reduced truck traffic in both directions, as is indicated in the following graphs:

Commuting and Tourism

More than 90 million people a year cross the border in the CaliBaja region. Of those, 50 million occur between San Diego and Tijuana, which makes that the busiest land-border crossing in the world. Some of the people crossing live in one country and work or go to school in the other. Table 2 gives a breakdown of cross-border workers and students by place of residence (U.S. residents commute to Mexico and vice versa):

Table 2. Cross-Border Workers and Students in the CaliBaja Region, 2020

Place of Residence | Cross-Border Workers | Cross-Border Students |

San Diego | 2,806 | — |

Imperial | 1,923 | — |

Tijuana | 34,817 | 6,986 |

Mexicali | 13,196 | 3,937 |

Many more people live in Mexico and commute to the U.S. than the other way around. One reason for this is that many workers are Mexican citizens with jobs in the U.S. But there also some U.S. nationals who live in Mexico due to the lower cost of living in the Baja California. Tensions at the border would affect the commute of those workers and students.

The remainder of the border crossings were for tourism purposes and went in both directions. These range from short day trips for shopping, dining and entertainment to extended vacations. Visit California reports that almost 7.7 million people visited California from Mexico in 2017, with about 550,000 arriving by air. The rest travelled either by water or by land, the latter of which involved crossing at the CaliBaja ports of entry. Spending by Mexican visitors to California totaled $3.1 billion in 2017, but that was spread through the entire state. Disruptions to border crossings would affect that spending and would particularly hit retail establishments and restaurants located near the border.

Future of the Region

The CaliBaja region features a vibrant economy that relies significantly on the cross-border movement of goods and people. Restrictions on those movements as have been proposed in the past would negatively impact the economy of the region and workers on both sides of the border. It also goes against the long-term cooperation that had previously existed between Mexico and the United States in areas, such as border infrastructure. It is essential that relations between the two countries with regards to the border remain positive and even be strengthened in the future to continue to provide access to jobs and education on either side of the border.

Above all, continued research and analysis of the workings of the CaliBaja regional economy must be a top priority for state and local government agencies, business entities, and civic organizations in the cross-border region. There is a need for more initiatives—within and across different organizations—to inform CaliBaja’s government, business, and civic leaders about the state of the binational regional economy and help generate ideas to promote CaliBaja’s continued growth and prosperity.

To learn more and get involved, get connected with the South County Economic Development Council.